Most readers here are aware of the fleets parked off major ports on both coasts;

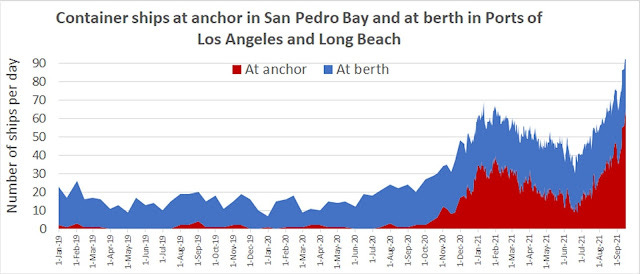

The number of container ships at anchor or drifting in San Pedro Bay off the ports of Los Angeles and Long Beach has now blown through all previous records and is rising by the day.

There were an all-time-high 65 container ships in the queue in San Pedro Bay on Thursday, according to the Marine Exchange of Southern California. Of those, a record 23 were forced to drift because anchorages were full.

Theoretically, the numbers — already surreally high — could go a lot higher than this. While designated anchorages are limited, the space for ships to safely drift offshore is not.

“There’s lots of ocean for drifting — there’s no limit,” Capt. Kip Loutit, executive director of the Marine Exchange of Southern California, told American Shipper.

“Our usual VTS [Vessel Traffic Service] area is a 25-mile radius from Point Fermin by the entrance to Los Angeles, which gives a 50-mile diameter to drift ships. We could easily expand to a 40-mile radius, because we track them within that radius for air-quality reasons. That would give us an 80-mile diameter to drift ships,” said Loutit.

Over at Splash247, they have a few interesting points to consider;

“What you see today is not only a black swan event, but in fact an entire bevy of black swans, and one which grows larger by the day, as more and more weak strands in the supply web snap,” Jensen says.

The US is indeed the real origin of this fiasco, the Dane agrees. Yet, he has answers to why warehouses are so full.

According to Sea-Intelligence research, many industries in the US are actually dangerously low on inventory.

Another explanation is the very real shortage of drivers to take goods from those warehouses that are actually full, to the consumers.

A game of musical chairs

Steve Ferreira, CEO of New York-based Ocean Audit, describes today’s clumped box situation as like a game of musical chairs.

“You don’t want to be left standing without a seat, and it’s a self-perpetuating cycle,” Ferreira says, giving a couple of recent examples such as Walmart ordering 149 containers of garbage cans on one single vessel or a French tire manufacturer inking a new charter to Houston.

“How are Michelin’s tires going to supply cars you can’t buy due to a chip problem?” Ferreira muses.

Andy Lane from CTI Consultancy, a container advisory, cites both archaic US logistics infrastructure as well as the near impossibility for retailers to have prepared for such a see-saw in demand as Covid presented as the two largest factors in today’s snarled container situation.

For decades, technology helped generations of MBAs design exquisite global supply chains built on incredibly delicate assumptions. As long as the models worked, it gave you the ability to save micro-cents to hundreds of dollars per unit as opposed to more robust but inefficient domestic supply chains.

The sand-cascade failures that we are starting to see in isolation can, if they cannot be controlled, combine in to significant economic dislocation - and with it - any chance for a sustainable recovery.

I think this will be the story of the next year. After an orgy of money printing and once in a century pandemic responses - injecting huge inefficiencies in to economies not designed for them - how will this settle out?

As I mentioned on Sunday's Midrats - you can't shoot up the horse forever.

So far, not so good.

Don't quit your day job.

Time to buy some vegetable seeds.