There are a few fundamentals that stand the test of time. It is important to keep them in the back of your head when watching events unfold. One of those is that some things of little or no value during times of peace are of immeasurable value at war.

Take for example the British territory of Gibraltar. From a strictly economic point of view, it is at best a dependency and, at worst an unnecessary drain on resources.

At war though? Incalculable value - one of the few, “The allies would have lost WWII without…” bits of geography.

So it is with the islands of the southwest Pacific.

It doesn’t take someone with a PhD in military history, an esteemed endowed Chair at SAIS, or an overpaid and under-appreciated gnome at some hide-bound think tank. No. All it takes is a Sailor, a globe, and an understanding of great circle routes to understand how we - and yes I mean “we” - got here.

The infrastructure project, funded through a $US63 million ($96 million) loan for road upgrades on Tanna and Malekula — another island of Vanuatu — was a beginning of sorts.

China has since lent the Pacific Island country money for other road upgrades, which have been celebrated locally for easing travel and promoting economic growth.

But Vanuatu's climbing debt levels, combined with economic shocks from natural disasters and a collapsed national airline, may weaken its appetite for more loans.

There is no economic interest in this area for the People’s Republic of China (PRC). As mentioned below, it is not that much money … but what value at D+1 can you place on setting the groundwork for positioning at war-start?

Maybe they’re just being a good global citizen? Maybe, but the PRC is not a nation known for her global charity. No. More like the administrator of the Ferengi Benevolent Association.

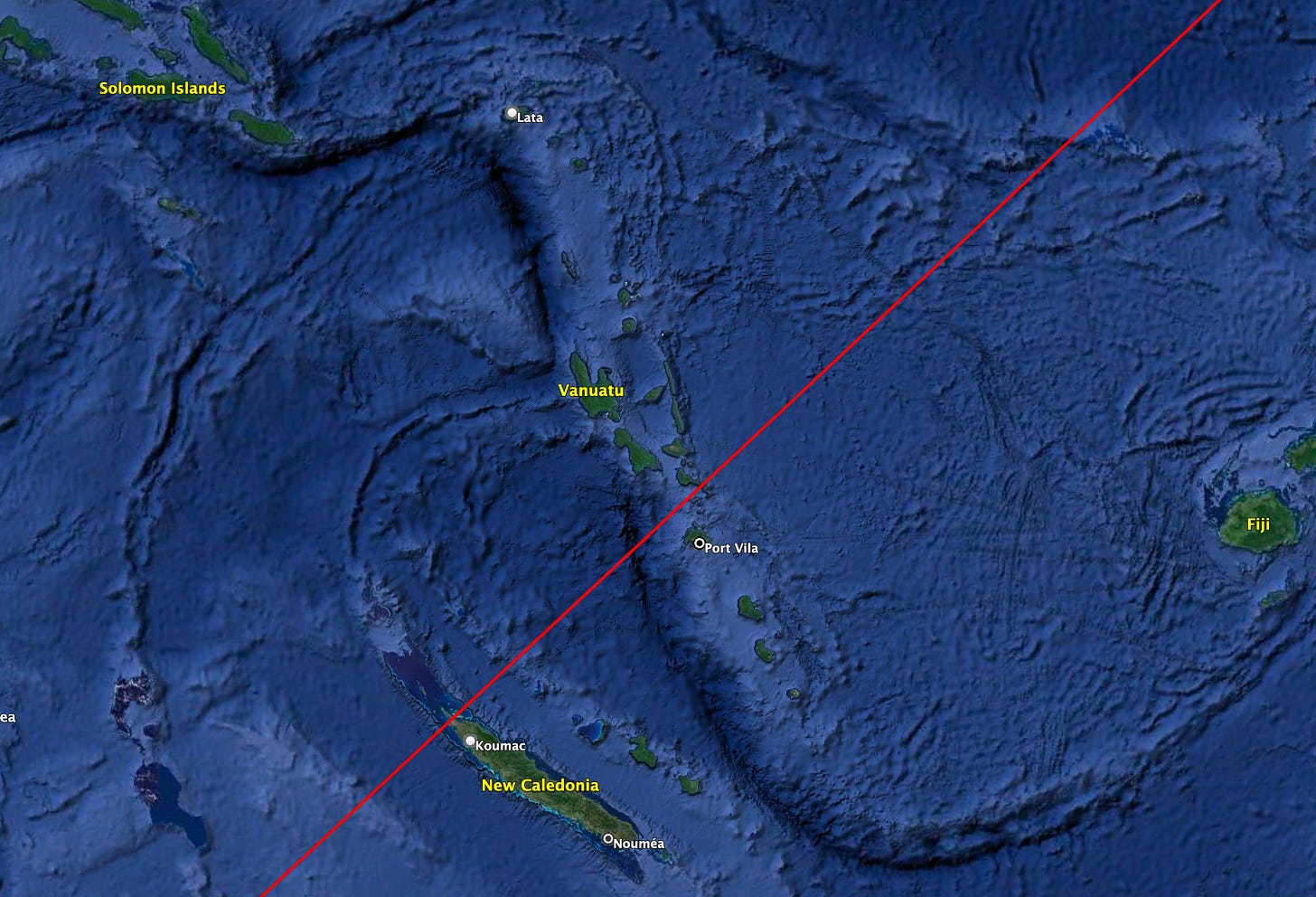

Look at the red line on the above graphic: it is the great circle route from California to Brisbane, Australia. I shouldn’t have to explain the importance and history, of the island chain in the upper-left-hand corner either: The Solomon Islands.

Over the past 20 years, China has become the largest lender in the Pacific.

Now Tonga, Vanuatu and Samoa are spending some of the biggest sums in the world to repay debts to China, as a proportion of their GDP, according to Lowy Institute analysis.

Tonga's annual debt repayments to China are nearly 4 per cent of its GDP — the third-highest level in the world.

It's a rate that Lowy research associate Riley Duke calls "astronomically high".

"On a global scale, it's really significant," he said.

In Samoa, debt repayments to China are 2.6 percent of GDP — the fourth-highest rate in the world — while Vanuatu's debt repayments (nearly 2 percent) also put it in the top 10.

What were we doing the last 20 years while China built its debt-slave empire in the southwest Pacific? Of course, you know.

The PRC does not let a crisis go to waste either.

"A loan of that size … is very difficult for an economy of Tonga's size to pay back," he said.

AidData analysis has found 85 per cent of China's loan-financed infrastructure projects in Tonga show signs of debt distress.

…

Tonga's finance minister said the government would help fund the debt repayments by improving how it collected tax.

A $30 million budget lifeline from Australia has also helped by funding public services, giving Tonga's government financial breathing space to make debt repayments to China, Mr Duke says.

But loan repayments to China commonly drain resources from public services such as health and education, and other pressing needs in the region, he says.

He said in Tonga's case, the government was spending more on servicing its debt than on health.

Either the PRC will:

Have to forgive that debt

Someone else - sounds like Australia is being the patsy for now - will have to cover the debt for them. Not ideal for the PRC, but distracting attention and draining funds from an ally of the USA and sending that money back to the Middle Kingdom is an acceptable Branch Plan

The PRC will use it as leverage for…other things

How you see this playing out would tell me a lot about how you think the world works.

The debt challenges for Pacific Island nations present a conundrum for China too, experts say.

While it wants to gain influence in the region, it is also risky to waive debts and create a precedent for other countries owing much larger sums.

Mr Duke said the money Pacific Island nations owed to China were "rounding errors" for the world's second-largest economy.

But they aren’t “rounding errors” for the poor island nations who happen to own some of the most strategically important real estate in the Pacific.

OK, perhaps that is giving the PRC too much credit - no pun intended.

Would we be this lucky?

Dr Nedopil Wang believes the Pacific's debt situation has been partly driven by China's naivety about the risks of lending.

He said the question now was whether China would use more innovative ways to reduce debt.

A debt-swapping agreement between China and Egypt in October may point to a solution to unsustainable debts in the Pacific.

Under debt swaps, creditors forgive part of the debt owed in exchange for investments that have a positive outcome, such as environmental protection or renewable energy.

Sometimes stupid economic and banking decisions are just that, stupid. Assuming the PRC is stupid has not been a good bet over the last few decades. I’d like to defer to the theory that the PRC knows exactly what it is doing. The trick is to make sure we can see it and act on that knowledge.

Just so. See also: Peru and Panama.

It's been said before but:

Poor country: When we meet with the Chinese, we get an Airport. When we meet with the US State Dept., we get a Lecture.