In the 1990s all the worst people were too busy cashing checks to worry about the rise of the People’s Republic of China (PRC).

For most of the 21st Century we were either distracted or deluded in to ignoring the that the PRC that wasn’t “pacing” the USA, but setting the chessboard to pass the USA. In some areas, they are well ahead of us and opening.

That leaves us in 2023 with fewer options to throw a spanner in their works as we wait for them to fall hard off the demographic cliff and then suffer from their own internal concerns to be as great of a threat outside their borders … maybe.

There are only a few China doves remaining. Some of them turned in to defeatists, others converted, and more than a few have faded in to their 1990s fluffed retirement savings.

Good news is that, better late than never, a more mature understanding of the threat to the global order from the PRC seems to now be the majority opinion.

The easy tools that might have been useful 20-years ago to build a bulwark are no longer an option, so some hard work needs to be done in the diplomatic and military fields, with hopefully some improvement on the sub-optimal informational efforts as of late.

What can be done on the economic side of the house? Well, here is something I heard in passing years ago but haven’t appreciated.

A little Easter Egg from the past. A legacy waiting to be leveraged.

I like this. Sure, there are dangers … but I like this … a lot.

I don’t know about you, but I’m tired of us playing softball while the PRC is playing for keeps.

Via Andrew Hale over at The Hill, this is the line that hooked me;

This, again, is just common sense and would be the very thing the Chinese government would do if the situation were reversed.

What is that?

The United States pays interest on approximately $850 billion in debt held by the People’s Republic of China. China, however, is currently in default on its sovereign debt held by American bondholders.

…

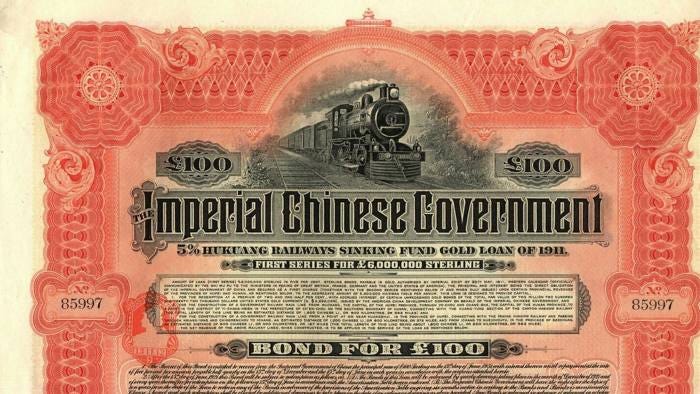

In 1938, during its conflict with Japan, the ROC defaulted on its sovereign debt. After the military victory of the communists, the ROC government fled to Taiwan. The People’s Republic of China was eventually recognized internationally as the successor government of China. Under well-established international law, the “successor government” doctrine holds that the current government of China, led by the Chinese Communist Party, is responsible for repayment of the defaulted bonds.

A private group of American citizens holds a large quantity of these gold-denominated bonds. This citizen-led group, the American Bondholders Foundation (ABF), serves as trustee with power of attorney for some 20,000 bondholders, whose bonds are valued at well more than $1 trillion.

Well, well, well.

Why are we playing Uncle Sucker?

Then-U.K. Prime Minister Margaret Thatcher’s tough negotiation stance on the return of Hong Kong to China led to a British settlement agreement on these same Chinese bonds in 1987. Thatcher said that for China to have access to U.K. capital markets, it had to honor the defaulted Chinese sovereign debt held by British subjects. Faced with that stark choice, China agreed.

Unfortunately, the U.S. failed to take such a common-sense stance. To this day, China has had access to U.S. capital markets while openly rejecting its sovereign debt obligations to American bondholders.

Of course, we know the answer here - but what can be done about the weakness of the past? All you can do is to not repeat the mistakes and double down on stupid.

There is precedent even more than the British example above:

Lest anyone wonder about the age of these bonds, it is irrelevant. What matters is that this is a sovereign obligation. As recently as 2010, the German government made its last payment for reparations from World War I. In 2015 Great Britain made payments on bonds issuances that dated from the 18th century.

We should show at least as much enthusiasm here as the PRC does for the South China Sea, the NBA, and Barbie movies;

This failure to act needs to end now.

Given that relations with China have deteriorated and there is bipartisan agreement on the threat from China, this matter can finally be acted upon by both Congress and the Biden administration. Getting settlement on this defaulted debt is not only right and just for the bondholders but, if done correctly, could also be a huge win for the U.S. taxpayer.

That, my friends, is low hanging fruit.

There is some vulnerability on our end given our own irresponsible levels of debt that would be helped if we could get our own house in order - but this looks to be the right move in today’s evolved relationship with the PRC.

It is time.

The game is afoot; time to play.

I’m starting to see this discussion show up in more places. The Chicomms are using debt as both a carrot and stick all over the world, it’s about time we did the same.

Maybe we should go to countries that have Chicomm financed infrastructure and give them these bonds to use in repayment when the Chicomms move to take control of their infrastructure.

This is new to me. Nice job, Sal.