The above graphic was floating around today with the news that the Brazil, Russia, India, China, and South Africa (BRICS) knitting club has added some rather interesting characters to their lineup;

Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates will join as members in January, the summit host, South African President Cyril Ramaphosa, said Thursday, the last day of the three-day meeting in Johannesburg. The announcement marked the first expansion since South Africa joined in 2010 at the invitation of China.

For Beijing and Moscow, adding members is part of a long-running — and often frustrated — effort to turn a largely symbolic grouping into a vehicle for remolding international trade and finance structures to protect their interests against future sanctions from the United States and its allies.

At moments like this it is important to back up a bit and talk about what BRICS actually is, and what it is trying to become.

While there is some truth in some of the more alarming discussions about what the BRICS movement is, let’s just remind ourselves how it started.

Where did BRICS get its start? The People’s Republic of China (PRC) and Russia trying to counter to the international order dominated by the USA? Nostalgia for the Cold War era “Non-Aligned Movement?”

It may be turning in to something like that, but started? Well, no.

It was an investment vehicle invented by the former head of - feel free to put on your tin-foil hat, stick a pin in you Klaus Schwab plush toy, and light your anti-illuminati candle now - the former head of Goldman Sachs, Jim O’Neill.

Let’s go back to the Goldman Sachs archive from 2001;

Jim O’Neill’s game-changing paper on the importance of BRICs economies

In 2001 and 2002, real GDP growth in large emerging market economies will exceed that of the G7.

At end-2000, GDP in US$ on a PPP basis in Brazil, Russia, India and China (BRIC) was about 23.3% of world GDP. On a current GDP basis, BRIC share of world GDP is 8%.

Using current GDP, China’s GDP is bigger than that of Italy.

Over the next 10 years, the weight of the BRICs and especially China in world GDP will grow, raising important issues about the global economic impact of fiscal and monetary policy in the BRICs.

In line with these prospects, world policymaking forums should be re-organised and in particular, the G7 should be adjusted to incorporate BRIC representatives.

Oh.

We’ll get to the G7 in a minute.

A lot has happened in the last 22 years, but ‘ole Jim seems to have lost control of his money maker;

“Brazil, Russia, and South Africa have all been, particularly since 2010, extremely disappointing,” says Jim O’Neill, former chair at Goldman Sachs Asset Management, as he discusses the economics of the BRICS bloc and questions the need for expanding membership. He speaks on “The Pulse With Francine Lacqua.”

You can catch a video from a couple of weeks ago with Jim in it on Bloomberg here.

It appears that the Western financial market makers have created a little monster we shall all have to deal with. The subjects of the little investment idea have decided to turn it in to something quite different.

Led by China and Russia, BRICS are morphing in to something aimed are creating a new international economic and rules based order by challenging the old. The present structure, led by the USA and its dollar simply is not what they want.

If the BRICS want to dance, then let’s dance. There is a natural counter to BRICS that in economic, human, and cultural criteria is superior and clearly differentiated.

Of course, I’m talking about the G7.

I am disappointed in a few of the nations who have thrown in with China’s tool that BRICS has become, and I think that with time we may be able to cut a few away, but we have what we have today.

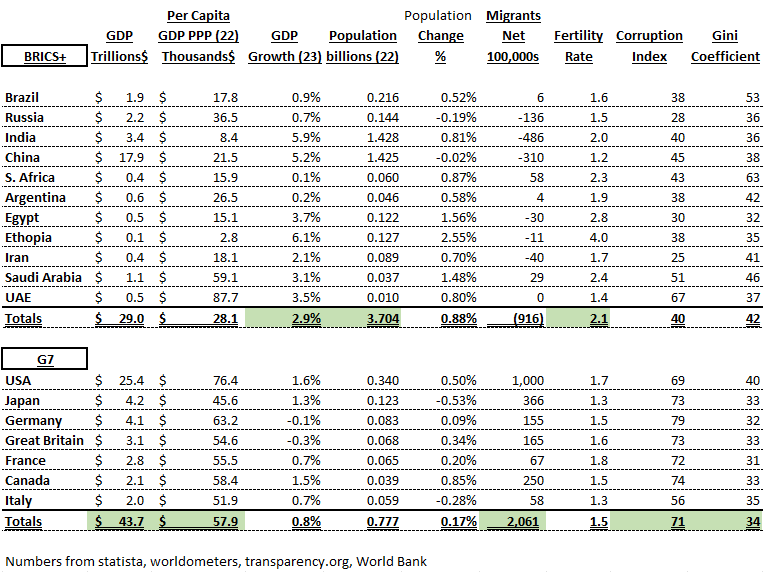

I had some time today to do a little research, so let’s rack-and-stack BRICS v. G7 and see the state of play.

(NB: the numbers are +/- but if I copied correctly, should be fine. Pardon any formatting or copy edit issues. I’m just one guy with a coffee break)

Executive Summary: G7 nations are fully developed nations with greater cumulative GDP. All G7 nations have representative governments. BRICS span the range from outright autocracy to flawed republics. Only India has decades of stable representative governance. G7 citizens have a much better standard of living. Their nations are attracting people and talent. They are less corrupt and have more equitable income distribution.

BRIC nations are significantly poorer, but their economies have upside potential more than the already fully developed G7 nations. They have over five times the population of the G7, but in addition to being poorer, they live in a less stable civil societies more likely to be prone to internal disruption.

The BRIC nations are not really the largest threat to the G7 nations. All G7 nations need to do is improve and have good stewardship of their positions generations worked to build, not import problems or sabotage the economic systems that produced a standard of living and civil society of such grandeur as never seen in human history.

Unfortunately that’s not happening.

“All G7 nations need to do is improve and have good stewardship of their positions generations worked to build”

Our government shoots us in the foot at every turn and then we wonder why things aren't going our way. Drill Baby Drill, stop wind and solar insanity, grow corn, beans and wheat, feed the cows and hogs, use amonia cycle for air conditioning (five times more efficent than Freon) and make "Made in America!" a reality again, do not allow LGBT people in the military or important positions, Make America GREAT Again!